A Guide to Covered Calls

📘 Covered Calls for Beginners

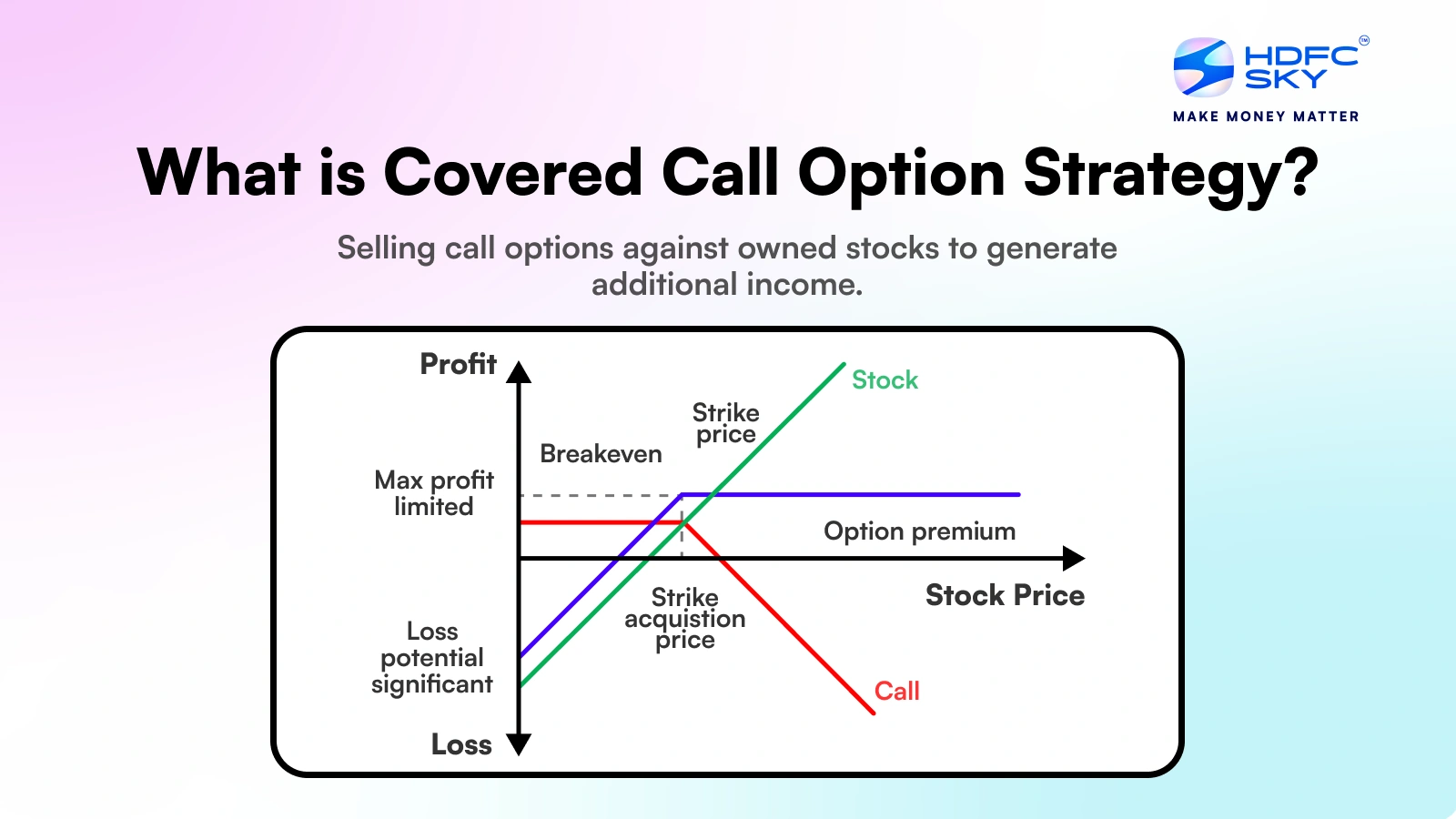

📌 Why Utilize the Covered Call Strategy?

- ✅ Win small and often

- ✅ Construct low-risk trades

Goal: Make more money with less risk - ⚠️ Short-term tax implications

(Taxed as short-term capital gains) - ❌ Avoid prediction-based decisions

Be conservative, not speculative - 🗓️ Sell calls with expiry no more than 45 days out

❌ Why You Should NOT Sell Naked Puts

- Limited upside, but unlimited downside

This risk asymmetry is dangerous - Poor for consistent cash flow

- Assigned to buy stock if price drops below strike

This only works if you have ample cash and want to own the stock anyway

💭 Mindsets to Embrace

-

Investment vs Speculation

Stick to strong principles → higher chance of long-term profit -

Lose little, win lots

Consistently favorable risk/reward setup = long-term edge

🧮 Option Value Basics

Option Value = Intrinsic Value + Time (Extrinsic) Value

- Intrinsic Value = Value if option is In The Money (ITM)

- Time Value = Value from time remaining until expiration

Example:

Underlying Stock: $45

| Strike Price | Intrinsic | Time Value | Total Option Value |

|————–|————|————-|———————|

| $50 (OTM) | $0 | $1 | $1 |

| $40 (ITM) | $5 | $1.5 | $6.5 |

📈 Key Financial Terms

- Sharpe Ratio: Risk-adjusted return

- Alpha: Performance relative to benchmark

- Beta: Stock’s volatility relative to market

🧠 Option Greeks (Quick Guide)

| Greek | Meaning |

|---|---|

| Delta | Price sensitivity of the option to the underlying asset. Also interpreted as the probability of being ITM. - Call: 0 → 1 - Put: 0 → -1 |

| Gamma | Rate of change of Delta (how fast Delta moves as stock price changes) |

| Theta | Time decay. Always negative. Highest when ATM. |

| Implied Volatility (IV) | Market’s expectation of volatility. Higher before events (e.g. earnings). Choose IV between 30% – 70% |

🔍 Choosing the Underlying Stock

(Skip if you already own the stock)

- Pick stocks you are comfortable owning long term

- Stable, low-beta stocks preferred

- Avoid earnings or high-volatility events near expiry

🎯 Choosing Strike Prices for Selling Covered Calls

✅ If you’re okay letting go of your stock:

- Choose Delta ~ 0.3 – 0.4

- Pick an OTM option with a chance to go ITM

→ Benefit: premium + potential capital gains

✅ If you want to keep your stock:

- Choose Delta close to 0

- Pick a deep OTM option

→ Lower premium, but higher chance of keeping shares

🗓️ Choosing Expiry Dates

- Sell options 30–45 days out

- Time decay (Theta) accelerates within final 30 days

- Watch out for:

- Earnings

- Political events

- Unexpected volatility spikes

🚪 Exit Strategy for Covered Calls

📏 Rules of Thumb

- The 1% Rule

- If extrinsic value < 1% of underlying price → Roll the call

- The 2 & 20 Rule

- If within 2 weeks, the option loses > 80% value → Buy back, lock in profit

- Code Red Rule

- If the stock crashes unexpectedly → Sell stock and exit all positions

🔄 By Scenario

| Scenario | Action |

|---|---|

| 📈 Stock Goes Up | Buy back call if you don’t want it called away |

| 📉 Stock Drops | Buy back for a gain, re-sell a lower strike safer call |

| ➖ Stock Stays Flat | Time decay works for you, roll out or resell at lower strike |

💡 The Poor Man’s Covered Call (PMCC)

Also known as: Long Diagonal Spread with Calls

🧱 Structure

- Buy a long-dated ITM call (LEAP)

- Expiry > 1 year

- Delta ≥ 0.75 (acts like a stock)

- Sell a short-dated OTM call

- Similar to covered call premium collection

- Be careful: If it moves ITM, close the position

🔁 Diagonal = Mix of:

- Vertical (same expiry, different strikes)

- Horizontal (same strike, different expiry)

📘 LEAP (Long-Term Equity Anticipation Securities)

- Options with > 1 year expiration

- Behaves like synthetic long stock (with less capital)

- Strong time value protection

- Look for Delta ≥ 0.75

📌 Extra Rules of Thumb

- Short-term volatility can create buying opportunities for option sellers

- Avoid selling too close to IV spikes (e.g. earnings, Fed meetings)